The Future of Ethereum Scaling (Fixing Gas Fees)

What’s the Ethereum gas issue?

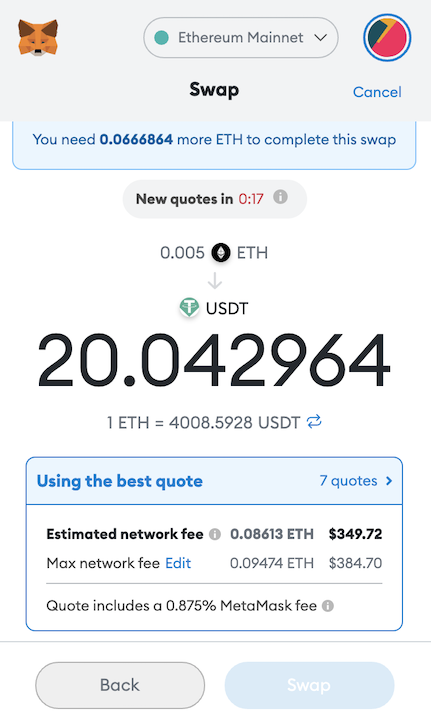

Lately, Ethereum ($ETH) gas fees have skyrocketed, cutting into the pockets of transactors and completely blocking out some low-capital participants. For those who aren’t familiar, gas fees are fees paid to process a transaction on the Ethereum blockchain, whose native token (Ethereum) is the second largest cryptocurrency behind only Bitcoin. Gas fees go up as network congestion grows. As an example, let’s say you wanted to swap .005 ETH (at the time of writing, worth about $20) for USDT, which is worth $1 each, through Uniswap. Uniswap is a DeFi application that allows you to, among other things, swap two Ethereum-based tokens. When I attempt to do this swap today, May 12th, 2021, this happens:

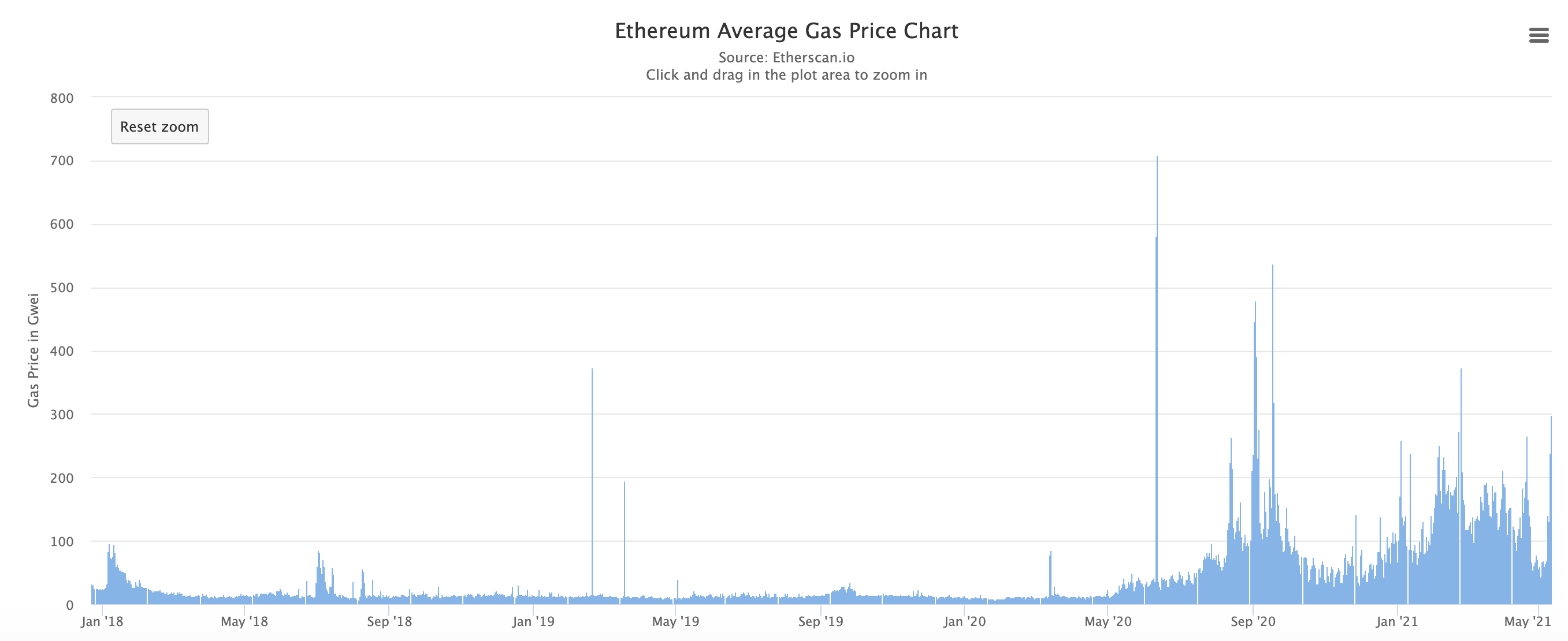

That’ll be a $350 gas fee. Insane - I would be at a net loss of about $330 just from swapping one token to another. To get a better picture of why this is, let’s take a look at the Ethereum gas and daily transaction charts from 2018 to today:

Charts courtesy of https://etherscan.io

To clarify, gas prices on the first chart are denominated in Gwei; one Gwei is equal to 0.000000001 ETH. As we can see from the second chart, daily transactions are trending upwards. So, as the network has to process more of these transactions, it must charge more Gwei as a gas fee to compensate miners, and each Gwei becomes more and more expensive in terms of dollars as the price of ETH continues to move up. So, when you want to swap tokens through Uniswap, which takes 10+ individual transactions, your gas fees start piling up.

Not only do current Ethereum scalability issues affect gas prices, they also affect transaction speed. This is clearly a problem, as Ethereum is home to many decentralized applications, NFTs, users, and developers. Its high decentralization, many developer tools, and network effects do not provide as much of an advantage if most users can’t afford gas prices and lack accessibilty to something that is meant to increase access. That’s where scaling solutions come in.

Scaling solutions

There are many proposed solutions to the Ethereum scaling issue. Some are already deployed, while others are still in development. Let’s go over a few prominent ones:

- Layer 2 solutions such as zero-knowledge rollups. These seek to minimize on-chain transactions by adding, as you probably guessed from the name, another layer on top of the main “layer 1” chain. They are also probably the most important.

- Sidechains. These are separate blockchains that run in parallel to the main Ethereum chain, come with cheaper transaction costs, and allow assets to be moved on and off of them. They do, however, come with security risks because attacks on these, unlike layer 2 solutions, could result in stolen assets. Polygon provides an interesting side-chain-like solution that allows various deployed Ethereum-compatible chains to take in/out tokens through a bridge smart contract, process cheaper transactions, and still communicate with the Ethereum main chain for additional security. They also offer other scaling solutions and security as a service.

- EIP1559. This will be released in a couple month’s time and features a new fee structure for gas.

- ETH 2.0. This actually involves changes to the Ethereum blockchain itself. Among the changes are a beacon chain (already active), proof of stake, and sharding.

Now, let’s dive deeper into some of these.

ZK-rollups with ZK-STARKS

Zero-knowledge rollups, a layer 2 solution, offer over 100x improved scalability by batching many transactions into one before sending it to the main Ethereum blockchain. Two popular zero-knowledge proofs used in these rollups are ZK-SNARKs (discussed in an earlier article) and ZK-STARKs. There are also other types of rollups such as optimistic rollups. For now, I’ll focus on ZK-STARK based ZK-rollups.

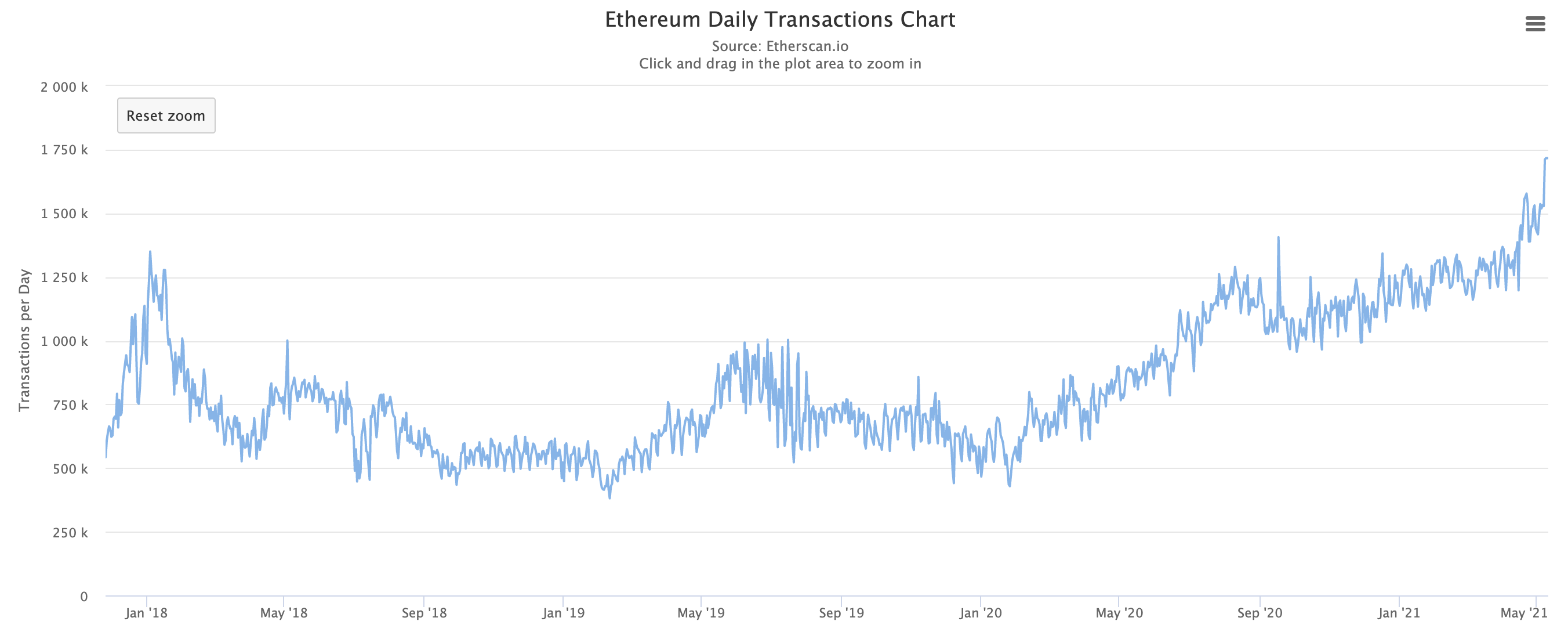

STARK based rollups have both on-chain, meaning on the Ethereum blockchain, and off-chain components. The on-chain component typically consists of proofs and two Merkle Trees: one for accounts and one for balances (see the picture below for an example of a Merkle Tree for accounts). The off-chain component is responsible for handling transactions, batching them, creating a STARK proof attesting to the validity of all transactions in the rollup, and sending the proof and the new Merkle Roots to the on-chain component.

A small example of a Merkle Tree that uses the Keccak-256 hash function

All funds are secured at the on-chain level, so an attack on the rollup could not steal them – a user can always withdraw by providing a path in the Merkle tree from their account to the root. Using these Merkle Trees and STARK proofs helps to minimize on-chain storage and costs. In addition to less frequent on-chain commitments due to batching and minimal on-chain storage, ZK-rollups guarantee the validity of all on-chain commitments at the time of commitment, which sets them apart from optimistic rollups.

I would like to take a short detour to discuss some key differences between STARK based ZK-rollups and SNARK based ZK-rollups. STARK proofs, unlike SNARKs, do not require a trusted setup phase. This means that there is never a chance for someone to learn the keys generated during a trusted setup phase and create fake proofs. They are also post-quantum secure (referring to quantum computing) and require simpler cryptography than their SNARK counterparts.

For all of these reasons, STARKs have been the proof of choice for applications such as dYdX, a popular decentralized exchange, and Immutable X, a layer 2 scaling solution for NFTs that partners with many large NFT marketplaces like OpenSea. Both of them use STARK based ZK-rollups powered by Starkware Industries, a company working on building better STARK based scaling solutions, and both feature 0 gas fees for users. To put the scaling effect of these rollups into perspective, Immutable X saved users over $400,000 on their first day using ZK-rollups. Layer 2s such as ZK-rollups will continue to play a vital role in the Ethereum ecosystem.

EIP1559

EIP1559, an Ethereum Improvement Proposal coming this July as part of the London Hard Fork, will implement gas fee related changes to the Ethereum main chain. To understand the changes being made, it is important to have a basic understanding of Ethereum’s current gas pricing model. Keeping the explanation simple, users submitting transactions are competing to be included in the next block. Blocks only have so much space, so when many transactions come in around the same time, gas fees shoot up since miners will obviously prioritize higher gas fees to earn more rewards. This is good for miners who benefit from increased fees, but not for users who try to transfer .005 ETH to 20 USDT during a time of network congestion and discover that they’re taking a net loss of hundres of dollars.

In order to combat this, EIP1559 introduces the concepts of a “base fee” and a “priority fee” into gas fees. The base fee moves according to network congestion. It is set algorithmically and constrained to certain values, so it can be reliably predicted (no more manually setting your gas fees, for the most part) and cannot skyrocket at times of congestion. Most importantly, however, the base fee is burned. This means that, during times of congestion, ETH will become deflationary. Currently, Ethereum inflation sits at about 4.5% per year, but EIP1559 should cut this down to under 1%.

The other part of the new gas fees, the priority fee, can be thought of as a tip to miners. It is also automatically set for most transactions. Since the base fee is burned, this priority fee is the only thing that miners keep; hence, the outrage of some miners at the introduction of EIP1559.

Additionally, EIP1559 contains a variable called ELASTICITY_MULTIPLIER, which is set to 2 and allows the maximum gas size per block to increase up to 2x its size (12.5 million gas to 25 million gas) during times of congestion. These “elastic blocks” should further help with throughput when traffic increases.

Let’s take a closer look at some of the EIP1559 code to see this in action:

priority_fee_per_gas = min(transaction.max_priority_fee_per_gas, transaction.max_fee_per_gas - block.base_fee_per_gas)

effective_gas_price = priority_fee_per_gas + block.base_fee_per_gas

signer.balance -= transaction.gas_limit * effective_gas_price

…

self.account(block.author).balance += gas_used * priority_fee_per_gas

The first line sets the miner’s priority fee to the minimum of the transaction-specific priority fee and the difference between the maximum gas fee (which can be specified by the user) and the current base fee. This ensures that the base fee is always paid first and in full. Next, the total gas price is calculated by adding the priority fee that we calculated in the last line and the current base fee. Then, in the third line, the user pays the gas fee. Finally, further down (after the …, which represents code that I left out), the miner is paid only the priority fee. The rest (the base fee) is burned.

ETH 2.0

Lastly, we can’t talk about future Ethereum scaling without mentioning the biggest change coming to Ethereum’s layer 1: ETH 2.0. This features, as stated before, a beacon chain, proof of stake, and eventually sharding.

To understand the beacon chain, we have to understand proof of stake and why it helps. Currently, Ethereum uses proof of work where miners compete to earn rewards for validating blocks using advanced hardware to quickly solve math problems in hopes that they will be first. This is simplifying the process, but that’s basically it. Obviously, this takes a substantial amount of electricity (depending on what you compare it to), uses hardware that requires a lot of resources to produce, and pushes the companies that make the hardware to develop mining hardware rather than other products.

Proof of stake is an alternative to proof of work that solves these problems. In proof of stake, token holders can “stake” their tokens (locking them up) to become a validator, help keep the network secure, and earn rewards. The idea here is that token holders do not want to see the token devalued, so it is in their best interest to be an honest validator. Non-honest validators also incur penalties.

The beacon chain, which is currently running parallel to the main proof of work Ethereum chain, gives stakers rewards in the form of more ETH (for example, the priority fee we mentioned earlier). These rewards sit at about 7.4% APR right now, but that will go down as more stakers join in. You must own a minimum of 32 ETH to stake it, but staking pools aggregate ETH from members of the pool in order to allow those who hold less ETH to participate.

Sometime in 2021 or 2022, the beacon chain will merge with the main chain and Ethereum will become a fully proof of stake blockchain. This merge will combine the beacon chain’s proof of stake with the main chain’s ability to execute smart contracts. This should also help reduce gas fees by reducing the time between blocks.

Sharding

I figured sharding required its own section for three reasons. One, it is likely not coming til 2022 or later. Two, it is still in development, so the exact way it will look is not clear yet. Three, sharding will have a larger effect on scalability than EIP1559 or proof of stake. Now that that’s out of the way, what is sharding?

Sharding is essentially a way of splitting up the work of verifying blocks into “shards”, which can be thought of as separate validator nodes. The idea is to increase scalability by dividing up the amount of work that verifiers need to do. For Ethereum specifically, this will mean dividing it amongst 64 shards, each with its own set of validators utilizing proof of stake. The beacon chain gains additional jobs with sharding: facilitating data communication between shards, maintaining a common state between shards, and assigning validators to shards at random, which helps combat attacks on a single shard.

How does the actual block verification process look with sharding? Each verifier performs data availability sampling (link with details provided at end of article) on the block in order to verify that all data is available and can be recovered. This technique only requires verifiers to look at a subset of the block’s data in order to verify that it is all there. Then, a zero knowledge proof is done to attest to the validity of the transactions in the block.

As of right now, the plan is for shards to only provide data availability (for example, there would be no execution of smart contracts on the shards). It would be up to layer 2s to use this feature, combined with zero-knowledge proofs, to create fast and efficient systems. At some point in the future, we could see execution happening on the shards, but that is much further away.

There are still technical hurdles related to sharding such as instant interoperability between applications on different shards, but it is without a doubt being worked on as you read this.

Summary

Even with EIP1559 creating more predictable gas fees/burning ETH and proof of stake reducing the time between blocks, layer 2 solutions will continue to play the most pivotal role in Ethereum’s scalability (yes, even after sharding). This is commonly understood, and it is also why so many layer 2s are in development right now. If you’re looking to build an application on Ethereum, I would highly recommend looking at various layer 2s in order to reduce gas costs for users and provide faster throughput.

ETH competitors

Another option for building a blockchain application is to use another chain. Ethereum does have its fair share of competitors, most of whom currently have notably smaller gas fees. They currently lack the network effects, development tools, and level of decentralization that Ethereum has, but they still see their fair share of volume. Notable competitors include Binance Smart Chain, Solana (my favorite alternative), Polkadot, and Cardano. In my opinion, there is room for multiple chains that excel at different things (however, some of these chains mentioned have downsides that may be a deal-breaker for your application. DYOR beforehand). Assets can also be bridged between many well-known chains.

What’s next?

I plan to write an article about the good and the bad of flash loans next. It will cover use cases, the code required to execute one, and front-running in the mempool where applicable.

Links/additional reading

Github page for EIP1559

https://github.com/ethereum/EIPs/blob/master/EIPS/eip-1559.md

Great post by Vitalik Buterin that goes more in depth on sharding. It explains the data availability concept mentioned earlier

https://vitalik.ca/general/2021/04/07/sharding.html

Interesting Twitter thread by Adam Cochran, a crypto investor, about how Ethereum and Solana can complement each other

https://twitter.com/adamscochran/status/1385291204938674189?s=20

Immutable X discussing their Starkware based ZK-rollups

https://www.immutable.com/blog/design-architecture

Further explanation on the beacon/main chain merge

https://ethereum.org/en/eth2/merge/